You likely saw the news – Bloomberg announced there is a 100% certainty that recession will be declared in the U.S. in the next 12 months.

Far too many investors, maybe even yourself, are already letting the fear and uncertainty of economic turmoil start to cloud the future.

What does that mean for your business? Your family? Your portfolio?

What’s trending on social media and in the school pick-up line and plastered all over the news is meant to make you stop and watch.

More specifically, it’s meant to feast on your fears and emotions because that’s what sells.

Yes, the title of this email is intentional because reason and data are often easily tossed aside when headlines start yelling…

“Recession! Recession! We’re in a recession!”

Is it natural to have at least some worry, even fear? Of course. That’s part of being human.

Is it understandable to find yourself checking for updates more and more throughout the day? Yes, that tends to happen.

We want to acknowledge what you’re feeling right now because the big R word (recession) can be heavy to hold in your heart.

Can we help make it a bit easier for you? What if we could show you what could realistically happen in the economy over the next year or so?

Our team and our clients have successfully survived, if not thrived through every recession since the ‘Tech Wreck’ of 1999-2000.

We’ve ‘earned our stripes’, as it were, and now, we’re ready to show you what we’ve seen walking with amazing investors just like yourself.

That’s why we’re introducing a four-part series about how realistic your concerns may be about the next few years. About what to really expect. Today is all about letting you know we have the data and the experience to show you the bigger picture.

Let’s start with answering a big question first…

Beware of Bears, but Don’t Hibernate.

Is the U.S. in a bear market? Yes, with the markets and economy where they are, we’re definitely in bear territory.

You’re likely feeling a full rollercoaster of emotions – from anger to sadness, pessimism and fear – and you might have the urge to grab all your toys and run to a different sandbox.

Before you sell all your stock market investments and hibernate until 2023, take a deep breath.

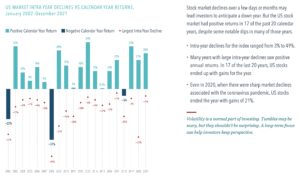

One of the best decisions we consistently see supported by data is staying invested in the market, even during a recession.

Let’s wind the clock all the way back to 1926. This was right before the Black Monday kicked off the Great Depression.

Since 1926, the U.S. stock market has rewarded investors with an annualized return of around 10%.

However, that’s for investors who stayed invested and didn’t exit.

Annual returns have jumped to as high as 54% and as low as -43%. That’s quite a range!

So, if you knew there were bumps ahead on your financial road, what’s one wish you’d make?

“How do I have more peace of mind while all of this is going on?”

Answer: By pulling back for a bigger, longer-term perspective.

Instead of looking at your portfolio for the next six months, think of the next 10 years.

No recession lasts forever. The average bear market in the U.S. associated with recessions typically lasts 18 months on average.

You (and your investments) can make it through 18 months – and there’s opportunity ahead for you!

This is the time to have a positive, data-supported optimistic outlook – despite what your friends and maybe even family are saying – and stick to your written financial plan.

Bumps will happen, but staying inside your investment vehicle during a wild ride is often the best way to stay safe.

Over the next few weeks, we’ll share more do-this-next tips and data-driven suggestions to help you stay on top of what you’re feeling.

Whatever the future holds, we’re here for you.

To your prosperity,

Your Hendershott Wealth Management Team