We all know that more than a few surprises popped up in the economy and stock market through 2022.

It’s important for our team to be the lighthouse in the storm for you. When the waves of economic uncertainty start to rise, it’s easy to get washed out to sea by the storm of doomsaying in the media!

Throughout the year, we provide constant commentary for you on what’s happening in the market, the economy, and around the world – and all in everyday words.

Before 2022 fades away in the rearview mirror, let’s take a quick look back to see what we learned.

1. The Stock Market is Down – That’s Rare, but Not Uncommon.

You’re likely disappointed your stock market investments over the past two years don’t seem very profitable.

It’s natural if you’re feeling at least a little hesitant, maybe even pessimistic about the outlook for stocks.

But this is normal. And the good news is when the stock market changes (and no one knows when it will), the change is likely to happen fast.

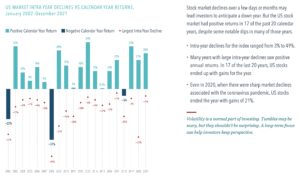

This insightful chart shows us that U.S. stocks had positive returns in 17 of the past 20 calendar years, despite significant dips during many of those years.

“There’s not a single year when the market was always positive. There will be times throughout any year when you see the market drop,” said Wes Crill, Head of Investment Strategists. “Most years still end up positive, and even though some do end up negative, […] you are better staying invested rather than panicking because of a drop.”

2. Stocks Usually Improve During Recessions (not after).

This interactive (and amazing!) chart, “Market Returns Through a Century of Recessions” clearly shows markets are ‘leading indicators’, and that markets around the world often reward investors even when the economy is slow.

Coincidentally, that chart also shows the uniqueness of recessions. There is no cookie-cutter recession and therefore, no clear signal when to get in or out of the market.

As a reminder, it’s a fool’s errand to try ‘timing the market’ as an investor. The real value is in staying invested through even the most tumultuous market conditions.

3. Inflation Doesn’t Last Forever.

During the “Great Inflation” years of the late 70s and early 80s, inflation soared to unprecedented heights. Its highest mark during that stretch was April 1980 when inflation hit a staggering 14.76%. But after that, inflation declined to below 7% in less than eighteen months.

While every recession is unique, there are many factors that can give us a reasonably optimistic outlook.

What does this all mean for your portfolio, grocery bill, and utility bills?

Well, it’s true that we’re likely going to be paying more than what we’re accustomed to for the next several months, but over the long-term, inflation is likely to decline rather quickly.

4. Learning Your Way Around Stock Market Investing is Worth a Fortune

There’s wisdom in knowing why you feel the way you feel about your stock portfolio.

The study of how emotions interplay with investor choices and decisions is called Behavioral Finance, and the reality is we are emotional beings who can easily let our feelings hijack our actions.

(If you know my story then you know I myself have made more than a few money mistakes in the past because I was feeling some kinda way.)

The very best, and most valuable, thing we can help you internalize is that market cycles are normal, and if you have the right portfolio and an effective rebalancing strategy, a “set it and forget it” strategy is not only the opposite of dereliction of duty, it’s actually 100% the right thing to do!

Dimensional founder David Booth is quick to point out why long-term investing is crucial.

“There were a lot of negative surprises over the past 25 years, but there were a lot of positive ones as well. The net result was a stock market that seems very reasonable, even generous. It’s a tribute to human ingenuity that when negative forces pop up, people and companies respond and mobilize to get things back on track.”

So, there is hope ahead as we will see calmer economic ‘seas’ in the near future.

If you’re unsure what direction you’re headed or whether you’re able to weather whatever 2023 brings financially, we are here for you. Click this link to schedule an initial call with us.