As a Top 100 Investopedia advisor who’s worked with over a thousand high-net-worth women for the past 20 years, I recognize several patterns and principles.

When Dartmouth finance professor Kenneth R. French released his list of “Five Things I Know about Investing”, it sparked conversations with our team and some of our clients at Hendershott Wealth Management. What are some lessons, principles, even truths we’ve learned serving women with wealth?

With so much uncertainty, confusion, and yes, fear flooding the news and headlines today, what do we know to be true about investing? What’s most important for women with wealth to know and understand moving into the future?

Here are my own five truths I know about investing based on what I’ve seen, experienced, and discovered:

- Some risk is inevitable. Some risk is even desirable.

- Investing is a measurable way of maximizing your dollar’s profit potential.

- Staying invested during volatility is still the best practice for realizing the best days of the market.

- Active investing, speculative investing, and ‘timing the market’ is largely a fool’s game.

- Women with wealth are typically better prepared emotionally to handle market volatility.

Over these next few minutes, I will expand on each of these truths in greater detail. These are principles that guide how our team of financial professionals build portfolios, select the appropriate investment funds and vehicles, and navigate investor sentiment across market cycles.

Most importantly, these truths help our team and clients stay grounded in the evidence of data and the intuitive nature of personal experience.

Note: it should go without saying, but in no way am I saying these truths are without repercussions. For each investment strategy or principle I introduce in this article, there are sometimes significant implications for investors and advisors. That said, these are five truths I believe to be timeless, but as with many conversations, time and truth walk hand-in-hand. These are five truths I have reason to believe will remain true far into the future.

1. Risk is Inevitable.

Any stock can rise or fall in value. Any investment vehicle, whether it’s cash, CDs, bonds, and especially more speculative opportunities, like cryptocurrencies, poses some element of risk.

One of the most dangerous traps any investor can entertain is the belief: “I can’t lose with this investment.” Even the safest ‘blue chip’ stocks can and do lose value. The only investing truth more certain than risk is the certainty of uncertainty.

You’re making an intentional assumption there will be at least some measure of unpredictability in the future, for your life and finances. Relationships change, children grow up, families move, businesses start and end, and every new headline or social shift carries the possibility of significant uncertainty.

The key to successful investing is not avoiding risk, which is impossible. The goal is to find the level of risk you’re comfortable accepting. Risk tolerance cannot be a one-size-fits-most approach.

Pairing your risk levels with a written, customized financial plan can help you stay calm and confident through the inevitable rollercoaster of the markets. One of the best investments you may ever make is working with one of our financial advisors to create your personalized financial plan.

Successful investors understand there are different types of risk, including:

- Company-specific risk: A poor earnings report, an executive scandal, or a hit news piece sponsored by a competitor can send a stock tumbling.

- Industry-specific risk: The entire airline industry was hurt by the events of September 11. The hospitality industry shut down entirely during the pandemic. Of course, industry-specific risk can also be affected by technology disruption. Blockbuster’s valuation peaked at $8B…and lost half its value in less than two years thanks to Redbox and various streaming options.

- Market risk: This is the type of risk that comes with owning any stock or mutual fund because it’s impossible to know what the market will do in the short term.

A key risk that’s often overlooked is investor emotion. Yes, every investor is a human encountering real decisions and situations often influenced by strong emotions, especially in times of uncertainty. This is where your Money Operating System® – often fueled by the core beliefs, habits, and principles you likely grew up with – can greatly influence how you think, feel, and act when it comes to money.

If you want to elevate your Money Operating System® to the next level, I recommend having an honest conversation with yourself about what you believe to be true about money. The good news is you can rewire your belief patterns and neural pathways (hello, neuroplasticity!) to adopt a new, more profitable Money Operating System® for your life.

2. Investing is a measurable way of maximizing your dollar’s profit potential.

To be a successful investor, you don’t need to outsmart the next person or invest before anyone else. You simply need to focus on two goals:

- Buying quality investments at a fair price.

- Holding those investments for a reasonable amount of time.

There are many different ways to measure whether an investment is quality and fairly priced. One of the simplest, most effective methods is to compare a company’s market value to its book value, sometimes designated as its P/B ratio.

Of course, even if you find quality investments selling at bargain prices, you still need to be patient. The key is not to panic and sell – again, managing your emotions as an investor is a discipline that can take time to mature. Relying on data, an experienced financial advisor, and your written, detailed financial plan is essential to avoiding emotionally charged investing decisions.

3. Staying invested during volatility is still the best practice for realizing the best days of the market.

You’ve likely heard the saying, “The market always comes back.” While it might not feel true in the moment, history has shown us this is true time and time again.

If you’re feeling tempted to cash out of a diversified portfolio during a downturn, remember: the best way to make money in the stock market is to stay invested. Time heals all wounds, as they say, including volatile markets.

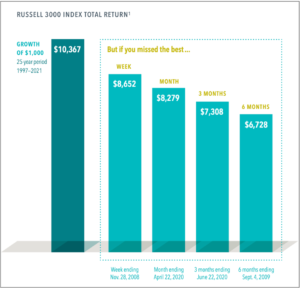

Research shows that over a 25-year period, if you cashed out for only the five-best performing days (which occurred in November 2008), you would have cost yourself over 14% of the cumulative 25-year return.

If you missed the best three months, which ended June 2020, you would have cost yourself approximately 27% of the same 25-year return.

Figure 1. The Cost of Trying to Time the Market, Dimensional Fund Advisors, 2022.

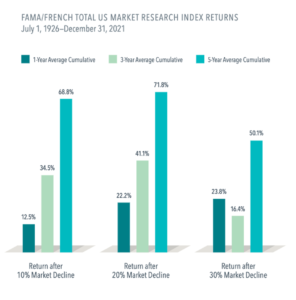

In fact, five years after market declines of 10%, 20% and 30%, the cumulative returns all top 50%. See Figure 2.

Fig. 2: History Shows That Stock Gains Can Add Up after Big Declines from Dimensional Fund Advisors, 2022.

Our research¹ shows that 73% of the time, returns on stocks were positive two years after a recession began.

Data shows us that staying invested is crucial to your long-term investment growth. If you invested $1,000 in U.S. stocks in 1970 without cashing out at any point, your investment would likely be worth $121,353 based on average S&P returns over that 50-year period.

But, what if you missed the best-performing day during that time? That same investment would be worth around $108,758. What if you missed the five best-performing days? That investment value drops to $77,056. The fifteen best-performing days? $43,472. Source.

You can see the value of staying invested. Of course, there are no guarantees in investing. However, if you stick to quality companies selling at bargain prices and remain patient through the ups and downs, you give yourself a much healthier chance of recouping what you may have lost while the market was down.

4. Active investing, speculative investing, and ‘timing the market’ is largely a fool’s game.

The vast majority of investors – both professional and amateur – cannot beat the market. Why? Because they’re trying to do just that: beat the market.

Timing the market can be an expensive game to play – and the cost may shock you. As one example, if you happen to time selling *out* of the market correctly, you still have to do one more critical thing correctly to have that trade actually be profitable.

You have to buy back in below where you sold out (and almost no one has the stomach to do that!) Otherwise, you’ve already lost money! And yet, so many investors (read: gamblers) try to ‘time’ the market. The effect, truly the aftermath of trying to time the market can be profoundly negative.

You can also see how much trying to ‘time the market’ can cost you and your financial future. Trying to outsmart the market is a losing battle. Instead, focus on building a diversified portfolio of quality investments and hold them for the long term. This way, you can take advantage of compounding returns and let your investments grow over time.

5. Women with wealth are typically better prepared emotionally to handle market volatility.

Why are women with wealth often better prepared for market uncertainties? Simply put, we know how to weather storms. We’re used to handling stress and last-minute changes. We also have a natural tendency to think about long-term implications.

A 2018 study by the Warwick Business School found that female investors consistently outperformed their male counterparts over a three-year period of time. Female investors dedicated more time and attention into researching their investment options, made fewer trades, chased fewer ‘speculative’ stocks, and generally held a more long-term perspective.

Another recent study by Fidelity Investments shows that a 22-year-old female investor with a starting annual salary of $50,000 will outpace her male counterpart by more than $250,000 in portfolio value by retirement age.

Anecdotally, our Hendershott Wealth Management team sees this scientifically proven advantage play out time and time again with our clients. As women, we understand the long-term implications.

We see value in understanding the investment opportunities we pursue before investing. We recognize there will be uncertainty and we are fully prepared to weather whatever the market brings.

That is why our firm focuses on serving women and couples with wealth. You likely have more questions than answers at this point in your investing journey. Our team of financial advisors is here to help you take the best step forward toward your financial goals.

Disclosures:

- Dimensional Fund Advisors, “Long Term Investors, Don’t Let a Recession Faze You,” April 3 2020.

Figure 1. In US dollars. For illustrative purposes. Best performance dates represent end of period (Nov. 28, 2008, for best week; April 22, 2020, for best month; June 22, 2020, for best 3 months; and Sept. 4, 2009, for best 6 months). The missed best consecutive days examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best consecutive days, held cash for the missed best consecutive days, and reinvested the entire portfolio in the Russell 3000 Index at the end of the missed best consecutive days. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

Figure 2. The average annualized returns for the five-year period after 10% declines were 9.54%; after 20% declines, 9.66%; and after 30% declines, 7.18%.

Market declines or downturns are defined as periods in which the cumulative return from a peak is –10%, –20%, or –30% or lower. Returns are calculated for the 1-, 3-, and 5-year look-ahead periods beginning the day after the respective downturn thresholds of –10%, –20%, or –30% are exceeded. The bar chart shows the average returns for the 1-, 3-, and 5-year periods following the 10%, 20%, and 30% thresholds. For the 10% threshold, there are 29 observations for 1-year look-ahead, 28 observations for 3-year look-ahead, and 27 observations for 5-year look-ahead. For the 20% threshold, there are 15 observations for 1-year look-ahead, 14 observations for 3-year look-ahead, and 13 observations for 5-year look-ahead. For the 30% threshold, there are 7 observations for 1-year look-ahead, 6 observations for 3-year look-ahead, and 6 observations for 5-year look-ahead. Peak is a new all-time high prior to a downturn. Data provided by Fama/French and available at mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French Website.

The Fama/French Indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

Results shown during periods prior to each index’s index inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. Short-term performance results should be considered in connection with longer-term performance results. There is no guarantee strategies will be successful. Diversification neither assures a profit nor guarantees against loss in a declining market.

Hendershott Wealth Management, LLC is an Investment Adviser registered with the Securities and Exchange Commission. Please contact us at advisors@hendershottwealth.com if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions. Please notify us if you do not receive statements from your Custodian on at least a quarterly basis. Our current disclosure brochure, Form ADV Part 2, is available for your review upon request. This disclosure brochure, or a summary of material changes made, is also provided to our clients on an annual basis.