As part of Hendershott Wealth Management’s comprehensive wealth management services, all clients have access to Ultra Tax Efficient Wealth ManagementSM (UTEWMSM): A practical suite of strategies to help high-net-worth investors reduce tax drag and protect their wealth.

And for clients with $1.25M+ in taxable assets, clients can now also unlock access to AQR’s Flex SMA, a tax-aware long-short investing strategy designed to generate consistent tax losses while deferring realized gains (and the associated taxes), without sacrificing investment returns or increasing market risk.

Tax efficiency plays a crucial role in building wealth. Taxes are the largest cumulative expense over your lifetime, and they can be a large burden on wealth building–but there are legal ways to minimize that tax burden while continuing to experience the magic of compound returns.

In fact, investors have been trying to reduce tax drag for as long as the stock market has been around. That’s why strategies like buy and hold, 1031 exchanges, and tax-loss harvesting exist–and why individuals often take advantage of options like exchange funds, Opportunity Zone funds, donor-advised funds, and more. But these strategies sacrifice investment quality for tax benefits.

For the investor who wants to keep their money liquid and compounding at market returns rather than paying large swaths of it to Uncle Sam, it’s never been more critical to seek out tax alpha: higher after-tax returns based on smart tax strategy.

That smart tax strategy is what we’re here to get into today.

The Power of Tax Deferral: How it Works and Why it Matters

The Compounding Advantage of Tax-Deferred Accounts

Tax deferral is a powerful tool for building wealth.

Capital gains taxes are only incurred when an asset–a stock, business, piece of real estate, etc.–is sold, which means your investments are able to grow tax-deferred in your accounts until that point.

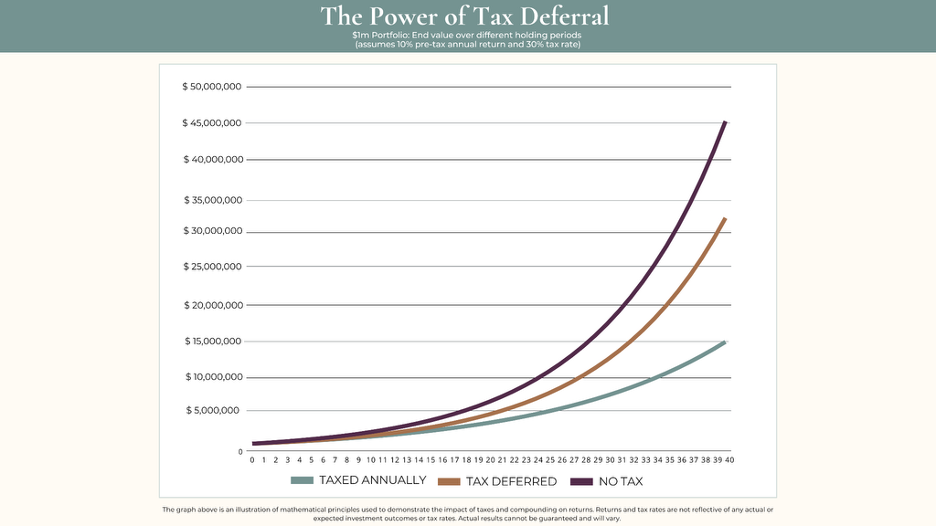

As shown below, over a long holding period, deferring taxes (and paying them when the gains are realized at the end of the period) leads to significantly more net worth for investors than paying taxes annually.

The graph above is an illustration of mathematical principles used to demonstrate the impact of taxes and compounding on returns. Returns and tax rates are not reflective of any actual or expected investment outcomes or tax rates. Actual results cannot be guaranteed and will vary.

SOURCE: HWM calculations (available upon request)

Deferring taxes magnifies the already powerful benefit of compounded returns over a long period of time–as long as the money remains in the account, it can keep growing.

One of the most common tax deferral practices that you’re likely already participating in comes in the form of IRAs and Roth IRAs.

For people who are looking for a tax break in the current tax year, traditional IRAs are an attractive option because they provide tax-deferred growth with pre-tax contributions.

Roth IRAs, on the other hand, offer tax-free growth and tax-free withdrawals in retirement–not the current tax year. This makes them appealing for people who expect to be in a higher tax bracket in the future.

We work with all Hendershott Wealth clients to ensure they’re maximizing their tax-deferred contributions through accounts like IRAs–while maintaining balance, because tax deferral does come with a downside.

What’s the tradeoff of tax deferral? Flexibility.

To maximize deferral, you often avoid selling, which can constrain your flexibility in rebalancing and diversification–and limit the opportunity to enjoy spending your growing wealth.

Many investors have grown accustomed to those limitations, and accepted them as an unavoidable cost because there hasn’t been a reasonable alternative that avoids losing meaningful portions of wealth to taxes.

The strategies within UTEWM℠ help you regain that flexibility—first through core tools available to all clients, and, where appropriate, through Flex SMA’s tax-aware long-short strategy for enhanced tax efficiency.

Tax-Loss Harvesting as a Tax Deferral Strategy

How to Reduce Investment Taxes and Maximize Wealth

In addition to maximizing tax savings through IRAs and Roth IRAs, one of the ways we work to increase clients’ tax efficiency is tax-loss harvesting.

Tax-loss harvesting involves selling positions with values below their original cost (i.e. the stock value has dropped since you purchased) and using those losses to offset realized gains. It’s an important strategy for selling appreciated assets and minimizing the associated tax bill.

At Hendershott Wealth Management we have long employed traditional tax-loss harvesting on behalf of our clients when conditions permit. However, tax-loss harvesting has a weakness: because markets tend to rise over time, the opportunities to harvest losses can disappear quickly.

Eventually (and sometimes very quickly!) we expect all of HWM’s client positions to have substantial unrealized gains due to rising markets, eliminating the opportunity to harvest losses altogether.

That’s why we’re excited to share that Hendershott Wealth Management is now able to offer a potentially much more effective way to reduce capital gains taxes–whether markets are rising or falling.

Beyond Tax-Loss Harvesting: Financial Planning Strategies to Reduce Capital Gains Taxes and Maximize Returns

How Tax-Advantaged Investments Can Help You Keep More of Your Wealth

The strategies inside Ultra Tax Efficient Wealth ManagementSM are designed to help investors like you build, diversify, and preserve wealth with a tax-first approach.

Think of the UTEWMSM suite of services like the financial equivalent of a specialized team of doctors working on a complex diagnosis: proactively working across disciplines to customize a plan to keep your wealth strong, flexible, and protected from unnecessary tax erosion.

Instead of viewing tax prep as a “season”, we take tax efficiency into consideration for your investment and financial plans all year long, year after year.

Having a menu of strategies we can customize to your situation means we aren’t facing the limitations of a single solution, as many investors have come to accept in the past.

Here are examples of some of the advanced strategies available to HWM clients through UTEWM℠:

- Annual Tax Letter & Return Review: Each year, we prepare a detailed tax letter for your CPA, summarizing tax planning actions on your behalf. Then we review your return for costly errors (like missed carryforwards or misreported gains).

- Smart Asset Location: When appropriate, tax-inefficient assets–meaning, the ones that are taxed as income–are placed in tax-advantaged accounts, while tax-efficient assets (like index funds) remain in taxable accounts for optimal treatment.

- Tax-Aware Investment Selection: We use ETFs and tax-managed mutual funds, combined with ongoing tax-loss harvesting when the market allows, to ensure your portfolio is positioned for after-tax growth.

- Equity Compensation & IPO Planning: From RSUs to ISOs to impending IPOs or tenders, we provide customized planning to help you minimize taxes and maximize the value of your equity events.

- Maximized Tax-Deferred Contributions: Each year, we guide you in fully leveraging Congress’s contribution opportunities, advising how much to contribute to which account–helping you reduce taxable income and grow wealth efficiently.

- Flex SMA: For eligible clients with $1.25M+ in taxable assets, we may implement a tax-aware long-short overlay in a separately managed account (via AQR Capital Management) to generate consistent tax losses, defer gains, and reduce tax drag while keeping your market exposure neutral.

These are just a few of the sophisticated strategies available within the Ultra Tax Efficient Wealth ManagementSM suite. Our goal is to pair day-to-day best practices (available to all clients) with advanced strategies like Flex SMA (when suitable) to make sure you’re maximizing your wealth, while minimizing what you owe in taxes.

Why Flex SMA’s Tax-Aware Long-Short Strategy Can Be a More Powerful Wealth Building Strategy Than Tax Deferral

Using Long-Short Strategies to Legally Reduce Capital Gains Taxes

As mentioned, traditional deferral delays taxes but can limit flexibility, and tax-loss harvesting depends on certain market conditions.

By contrast, Flex SMA seeks to generate realized losses (usable against taxable gains) while deferring gains—so you can diversify, rebalance, and fund goals more tax efficiently, whether markets are up or down.

The strategy expands your portfolio by adding additional positions in what is called an investment overlay, and enhances tax loss harvesting opportunities in a very specific way. The overlay is market-neutral (equal long and short positions designed to neutralize market risk), systematic (rules-based, not trying to time the market), and highly diversified (using hundreds of positions).

This combination provides consistent tax benefits without sacrificing investment returns or adding market risk. AQR manages the separate account; our team at HWM optimizes the plan across all assets over your entire investing life, integrating it with your individual situation and goals, and coordinating with your CPA.

For more details about how Flex SMA can be applied to your financial situation–and modeled scenarios of how it works–

download our whitepaper:

Flex SMAs and Tax-Aware Long-Short Investing Strategies

Within Ultra Tax Efficient Wealth ManagementSM

In it, you’ll learn how investors leverage tax-aware long-short strategies

like Flex SMAs to strategically minimize tax drag, enhance portfolio

growth, and preserve more of their wealth for the future.

Is Flex SMA Right for You?

The strategies inside Ultra Tax Efficient Wealth Management℠ are for every Hendershott Wealth client—together, they make up the baseline, proactive tax-aware way we manage wealth.

Flex SMA’s tax-aware long-short strategy is the keystone offering within UTEWM℠, and is suitable for investors who:

- Hold $1.25M+ in taxable assets

- Have concentrated or highly appreciated holdings and want to diversify tax-efficiently

- Face large capital gains realizations (e.g., business sale, real-estate sale, IPO, etc.)

In these cases, Flex SMA’s consistent loss generation + gain deferral can materially reduce near-term taxes while preserving growth and liquidity.

And, in doing our independent and thorough due diligence, we discovered that implementing a tax-aware long-short strategy is what hypothetically:

→ Makes it possible for an investor with a $12M concentrated stock portfolio to diversify their holdings in just two years–without the $4m tax bill,

→ Allows a retired couple to save $1.6m in taxes during retirement and direct that money to their kids rather than the IRS, and

→ Empowers a 38-year old startup employee to take her $9M IPO windfall, defer capital gains taxes on it, and turn it into $20M by age 65.

And, more generally, it’s what allows you to keep your options open, stay flexible in uncertain markets, and confidently say yes to the life you’re working so hard to create.

Tax-Efficient Investing: A Smarter Path to Long-Term Wealth

Tax-aware investing isn’t just a technical concept.

Really, this is a quality-of-life strategy. It means you get to keep more of what you earn, which expands your options in life.

When you reduce the drag of taxes, you can experience greater freedom in your life to:

- Retire earlier—or retire better

- Travel without worrying about market timing

- Fund your child’s education with less stress on your long-term wealth

- Make charitable gifts more generously

- Stay invested longer—and more confidently

That’s the essence of smart, ethical tax planning: you keep more of your money, without needing to take unnecessary risk or compromise your growth.

At its core, tax efficiency is about giving you more freedom, confidence, and peace of mind. That translates to more breathing room to live the life you’ve worked hard for today—and leave the legacy you dream of.

If you’re evaluating diversification, a liquidity event, or a large tax bill, we’ll help you compare tax-efficient paths—including when Flex SMA and other sophisticated strategies are (and aren’t) the right fit.

You’ll be paired with one of our Lead Advisors for a 45-minute meeting where we’ll take a look at your financial picture, help you assess your current tax drag, and figure out if implementing a tax-aware long-short strategy is a smart next step for you.

If it’s not, we’ll point you in the right direction. But if it is—it could make a seven- or even eight-figure difference over your lifetime.

SCHEDULE YOUR DISCOVER CALL TODAY

Frequently Asked Questions

What is Ultra Tax Efficient Wealth Management℠ (UTEWM℠)?

UTEWM℠ is Hendershott Wealth Management’s suite of services designed to help clients reduce tax drag and preserve long-term wealth. It includes planning strategies available to all clients (like tax-return reviews, asset location, and equity compensation planning) as well as advanced solutions like Flex SMA for suitable investors.

What is Flex SMA, and how does it work?

Flex SMA is a separately managed account offered through AQR Capital Management that uses a tax-aware long-short overlay. This overlay is traded to systematically generate tax benefits by realizing tax losses while deferring gains—helping high-net-worth investors reduce capital gains taxes without sacrificing investment returns or adding market risk.

Who is eligible for Flex SMA?

Flex SMA is suitable for investors with $1.25M or more in taxable assets who face significant capital gains exposure (e.g., from concentrated stock, business sales, or appreciated real estate).

How is Flex SMA different from traditional tax-loss harvesting?

Traditional tax-loss harvesting depends on market downturns. Flex SMA, by contrast, creates consistent opportunities for realized losses through a market-neutral long-short overlay—making tax efficiency possible in both up and down markets.

Do I lose access to my money if I use Flex SMA?

No. Your assets remain in your account at the custodian (such as Fidelity or Schwab). Flex SMA have no lock-up, so you maintain liquidity and access to your funds. That said, the Flex SMA is not like a bank account where you can ongoingly add and withdraw money. It is a long-term strategy with the option to change your mind.

What are the costs of Flex SMA?

Like any managed investment, Flex SMA has management and financing costs—starting around 0.6% annually. For suitable investors, the expected tax savings outweigh these costs many times over.

How do I know if UTEWM℠ or Flex SMA is right for me?

It depends on your goals, tax situation, and the size of your taxable portfolio. Our team runs customized analyses to estimate potential tax savings and ensure any strategy fits your long-term plan. A complimentary Discovery Call is the best way to evaluate fit.

Disclaimer

All investing involves risk, including the potential loss of principal, and there is no guarantee that any investment plan or strategy will be successful.

Advisory services are provided by Hendershott Wealth Management, LLC (“HWM”), an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

Content discussed is for information purposes only and does not constitute an offer, or solicitation of an offer, or any advice, or recommendation to purchase any securities or other financial instruments–and may not be construed as such.

All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation–and all examples are hypothetical, not reflective of actual executed transactions or client experiences.

The realized tax benefits associated with tax-aware strategies may be less than expected or may not materialize due to the economic performance of the strategy, an investor’s particular circumstances, prospective or retroactive change in applicable tax law, and/or a successful challenge by the IRS. In the case of an IRS challenge, penalties may apply. The discussed tax-aware strategies have additional costs that will increase investors’ expenses and as a result will reduce returns.

There is a risk of substantial loss associated with trading commodities, futures, options, derivatives and other financial instruments. Before trading, investors should carefully consider their financial position and risk tolerance to determine if the proposed trading style is appropriate.

When trading these instruments, one could lose the full balance of their account. It is also possible to lose more than the initial deposit when trading derivatives and using leverage. All funds committed to such a trading strategy should be purely risk capital.

Investment minimums apply. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation.